Exactly How Home Equity Loan Can Money Your Next Big Task

Exactly How Home Equity Loan Can Money Your Next Big Task

Blog Article

The Leading Reasons That House Owners Select to Protect an Equity Car Loan

For lots of home owners, selecting to safeguard an equity finance is a strategic economic decision that can supply various benefits. From settling debt to taking on major home renovations, the reasons driving people to opt for an equity funding are diverse and impactful (Home Equity Loans).

Financial Obligation Consolidation

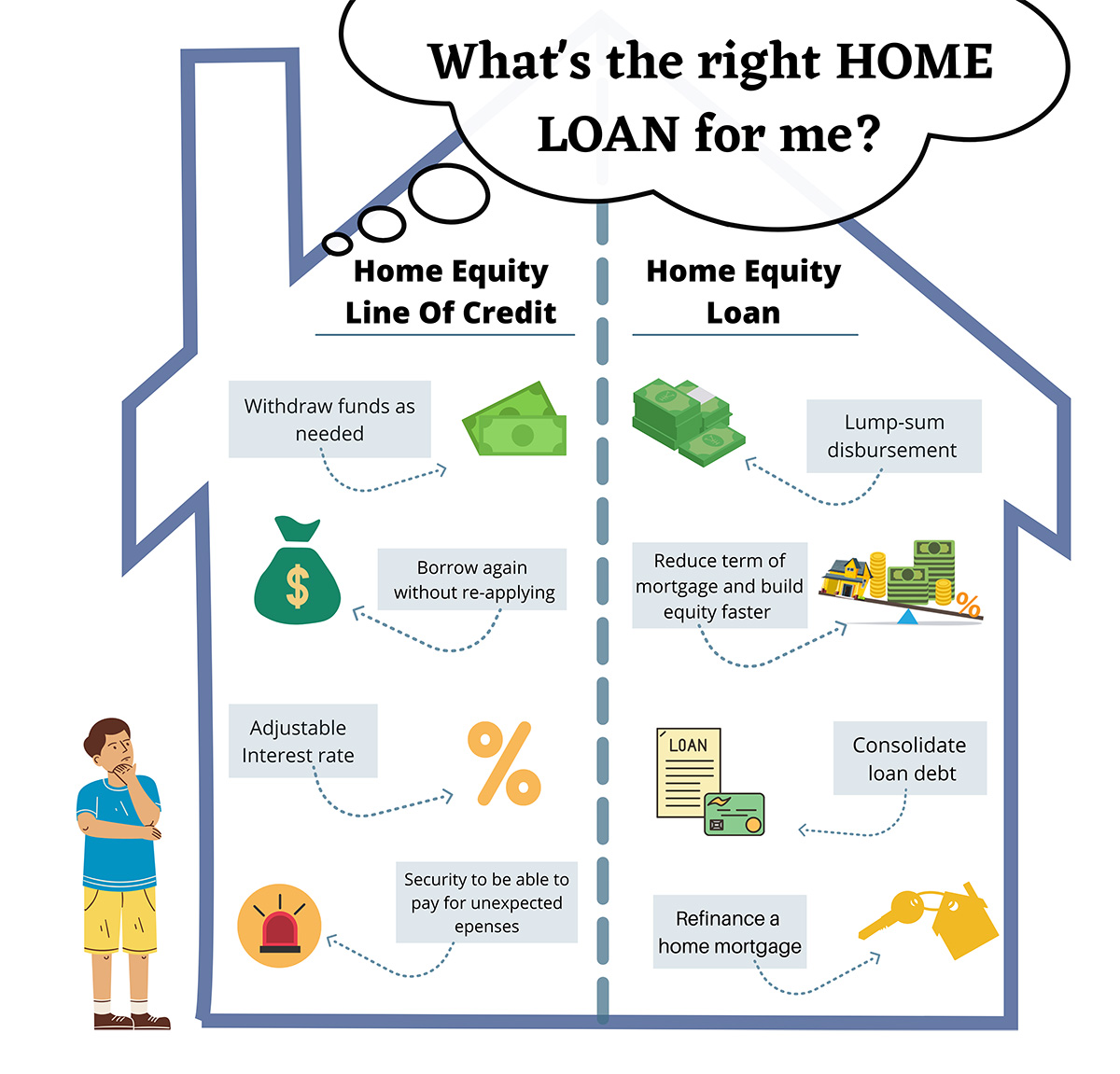

Home owners usually decide for safeguarding an equity financing as a critical economic action for financial debt consolidation. By leveraging the equity in their homes, people can access a round figure of money at a reduced rates of interest compared to other types of loaning. This resources can after that be utilized to pay off high-interest financial debts, such as charge card equilibriums or individual loans, allowing house owners to enhance their monetary responsibilities right into a single, much more convenient month-to-month repayment.

Financial debt consolidation with an equity finance can offer numerous advantages to homeowners. It simplifies the repayment process by integrating several debts right into one, lowering the threat of missed out on settlements and potential charges. The lower rate of interest price linked with equity loans can result in substantial price savings over time. Furthermore, consolidating debt in this fashion can boost an individual's credit report by decreasing their total debt-to-income proportion.

Home Enhancement Projects

Considering the improved value and capability that can be achieved through leveraging equity, lots of people opt to allot funds in the direction of various home renovation projects - Alpine Credits copyright. Homeowners frequently choose to protect an equity financing specifically for remodeling their homes as a result of the considerable returns on investment that such projects can bring. Whether it's updating obsolete features, broadening living areas, or boosting power effectiveness, home renovations can not just make living spaces more comfy but additionally enhance the general value of the residential property

Usual home renovation projects moneyed through equity loans include cooking area remodels, restroom improvements, basement completing, and landscape design upgrades. These tasks not just enhance the lifestyle for home owners yet additionally add to improving the visual charm and resale worth of the residential property. Additionally, spending in premium products and contemporary layout aspects can even more raise the visual allure and functionality of the home. By leveraging equity for home improvement tasks, home owners can produce areas that far better match their requirements and preferences while additionally making an audio economic investment in their building.

:max_bytes(150000):strip_icc()/dotdash-mortgage-heloc-differences-Final-6e9607c933e9467ba4d676601497a330.jpg)

Emergency Expenses

In unpredicted scenarios where prompt financial assistance is needed, protecting an equity car loan can give homeowners with a sensible solution for covering emergency expenditures. When unexpected events such as clinical emergencies, urgent home repair services, or unexpected job loss emerge, having access to funds through an equity finance can supply a security internet for property owners. Unlike other kinds of loaning, equity fundings typically have lower rates of interest and longer payment terms, making them an affordable alternative for addressing instant economic demands.

One of the essential advantages of using an equity car loan for emergency expenditures is the speed at which funds can be accessed - Alpine Credits Home Equity Loans. House owners can quickly tap right into the equity developed in their residential or commercial property, allowing them to address pushing monetary issues without hold-up. In addition, the adaptability of equity car loans enables homeowners to borrow just what they need, avoiding the problem of taking on too much financial debt

Education And Learning Funding

Amid the search of college, safeguarding an equity lending can act as a calculated economic resource for home owners. Education and learning financing is a considerable concern for several households, and leveraging the equity in their homes can give a way to gain additional hints access to necessary funds. Equity financings typically offer reduced rate of interest compared to various other kinds of lending, making them an appealing alternative for financing education expenses.

By using the equity developed in their homes, home owners can access considerable amounts of money to cover tuition charges, books, holiday accommodation, and other related expenses. Equity Loan. This can be particularly useful for parents seeking to support their youngsters through college or individuals seeking to further their own education. In addition, the interest paid on equity fundings might be tax-deductible, supplying prospective monetary benefits for customers

Inevitably, making use of an equity loan for education financing can help people spend in their future earning potential and occupation improvement while successfully managing their financial responsibilities.

Financial Investment Opportunities

Conclusion

To conclude, property owners pick to safeguard an equity loan for various reasons such as financial obligation loan consolidation, home renovation tasks, emergency expenditures, education financing, and financial investment possibilities. These lendings provide a means for home owners to gain access to funds for vital financial needs and goals. By leveraging the equity in their homes, house owners can benefit from lower rates of interest and versatile payment terms to attain their financial objectives.

Report this page